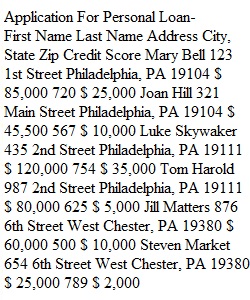

Q CIS250 – Advanced Excel Case Study 1 Copyright 2022 Post University, ALL RIGHTS RESERVED Due Date: 11:59 pm EST Sunday of Unit 2 Points: 100 Overview: In this case study, you have been tasked with generating a loan approval workbook that will determine if an applicant is eligible for a personal loan and if so, what the loan rate should be based on a set of pre-defined criteria. The bank manager has created the basic layout of the application she wants to use but has asked you to provide the formulas that will drive the initial quote. Instructions: Determine Rate: You need to provide a rate for each customer based on their credit score. Any user who has a score less than 600 should be denied. 1. Open case_study1_data and save as case_study1_LastFirst (use your own Last and First name). IF Function – Use the IF Function to figure out if an applicant is eligible for a personal loan. Please review this tutorial: Excel IF Functions For Beginners for help. 2. Display the Approval Form worksheet and create an IF statement in cell I3 to determine if the applicant is eligible for a personal loan. Use the criteria below as part of your logic statement: ? Credit Score < 600 = “Denied” ? Credit Score >= 600 = “Approved 3. Copy using the Fill Handle the IF statement in cell I3 to into the Range I4:I10. VLOOKUP Function – Use the VLOOKUP Function to determine the rate of for those customers that were approved based on their credit scores. Please review this tutorial: VLOOKUP Functions for Beginners for help. 4. Create a VLOOKUP function in cell J3 that uses the Credit Score in cell F3 to generate a rate based on the array in cells N4:O10. NOTE – Make sure to use the correct cell referencing. 5. Copy using the Fill Handle the VLOOKUP statement in cell J3 to into the Range J4:J10. 6. Delete out any Rate value for those customers that were denied. Copyright 2022 Post University, ALL RIGHTS RESERVED Calculate Payment: PMT Function – Use the PMT Function to calculate the payment. Remember that the Yearly Periodic Rate is the Rate divided by the number of Months. Please review this tutorial: Excel PMT() Function Basics for help. You will calculate the payment quote for each customer. 7. Calculate the periodic rate of the loan in cell K3. 8. Copy using the Fill Handle the Periodic Rate in cell K3 to into the Range K4:K10. 9. Delete out any Rate value for those customers that were denied. 10. Use the PMT Function in cell L3 to calculate the payment. Make sure to return a positive value. 11. Copy using the Fill Handle the Payment in cell L3 to into the Range L4:L10. 12. Delete out any Rate value for those customers that were denied. Determine Maturity Dates: You will create a working list of all existing accounts that provides the number of days remaining on their loan and an overall look at all the accounts maturity dates. 13. Display the Existing Accounts worksheet and calculate the number of days remaining for each existing account based on today’s date. You will need to use the Today() Function in your calculations. 14. Calculate the maximum number of Days Remaining for all existing accounts in cell C17. 15. Calculate the minimum number of Days Remaining for all existing accounts in cell C18. 16. Calculate the average number of Days Remaining for all existing accounts in cell C19. 17. Save and close the file. Requirements: ? Submit the completed case_study1_LastFirst Excel file. Be sure to read the criteria below by which your work will be evaluated before you write and again after you write. Copyright 2022 Post University, ALL RIGHTS RESERVED Evaluation Rubric for Case Study 1 Assignment CRITERIA POINTS Save as case_study1_ LastFirstName 3 Add logical statement the evaluates if the credit score is over 600 in cell I3. If so, return Approved, else return Denied. 15 Filled range I4:I10 and deleted out customers Denied. 5 Use a VLOOKUP in cell J3 to determine the rate based on cell F3. 10 Filled range J4:J10 and deleted out customers Denied. 5 Calculate the Periodic Rate in cell K3. 10 Filled range K4:K10 and deleted out customers Denied. 5 Calculate the Loan Payment in cell L3. 10 Filled range L4:L10 and deleted out customers Denied. 5 Calculate the number of days remaining on each existing loan. 8 Calculate the maximum number of days remaining on Existing Accounts. 8 Calculate the minimum number of days remaining on Existing Accounts. 8 Calculate the average number of days remaining on Existing Accounts. 8

View Related Questions